Published as part of the ECB Economic Bulletin, Issue 7/2024.

After years of fiscal support to mitigate the impact of the COVID-19 pandemic and the recent energy crisis, plans were made to improve the euro area countries’ fiscal positions more markedly in 2024. The general escape clause embedded in the EU’s Stability and Growth Pact was activated over 2020-23 to ensure that fiscal policies could provide the support needed by EU economies to address the adverse impact of the pandemic and the energy crisis. For 2024, the European Council agreed in June 2023 on country-specific recommendations for fiscal policies.[1] These called for fiscal policy normalisation as the energy crisis gradually faded. At the same time, the fiscal guidance reflected the fact that 2024 would be a year of transition towards a reformed EU fiscal framework. The new framework came into force on 30 April 2024 with a view to becoming operational as of 2025.[2] Against this background, this box provides an overview of euro area fiscal developments in 2024, as reflected by revisions to fiscal positions across various rounds of Eurosystem and ECB staff macroeconomic projections for the euro area.

The cyclically adjusted fiscal position of the euro area as a whole is indeed projected to continue improving in 2024 but to remain substantially below its pre-pandemic level (Chart A). In the September 2024 ECB staff macroeconomic projections, the euro area cyclically adjusted primary balance (CAPB) − the budget balance net of cyclical developments and interest spending − was seen as improving from -1.9% in 2023 to -1.4% of GDP in 2024. After a marginal increase in 2023, this more substantial improvement largely reflects the unwinding of most of the support measures implemented by euro area governments in response to the energy crisis and high inflation.[3] Despite this improvement, in 2024 the euro area CAPB is projected to remain over 2 percentage points below its pre-pandemic (2019) level. The high-debt group of countries tended to have a weaker cyclically adjusted primary position than the low-debt group over the entire period from 2019 to 2024, notwithstanding the larger projected improvement in 2024.[4]

Chart A

Developments in the cyclically adjusted primary balance: euro area and low vs high-debt countries

(percentages of GDP)

Source: ECB staff macroeconomic projections for the euro area, September 2024.

Notes: The chart shows GDP-weighted averages of the CAPB for the euro area aggregate and the two groups of countries according to debt level. The “high-debt countries” group comprises euro area countries with a government debt-to-GDP ratio higher than 90% in 2023 (Belgium, Greece, Spain, France, Italy and Portugal). The rest are grouped as “low-debt countries”.

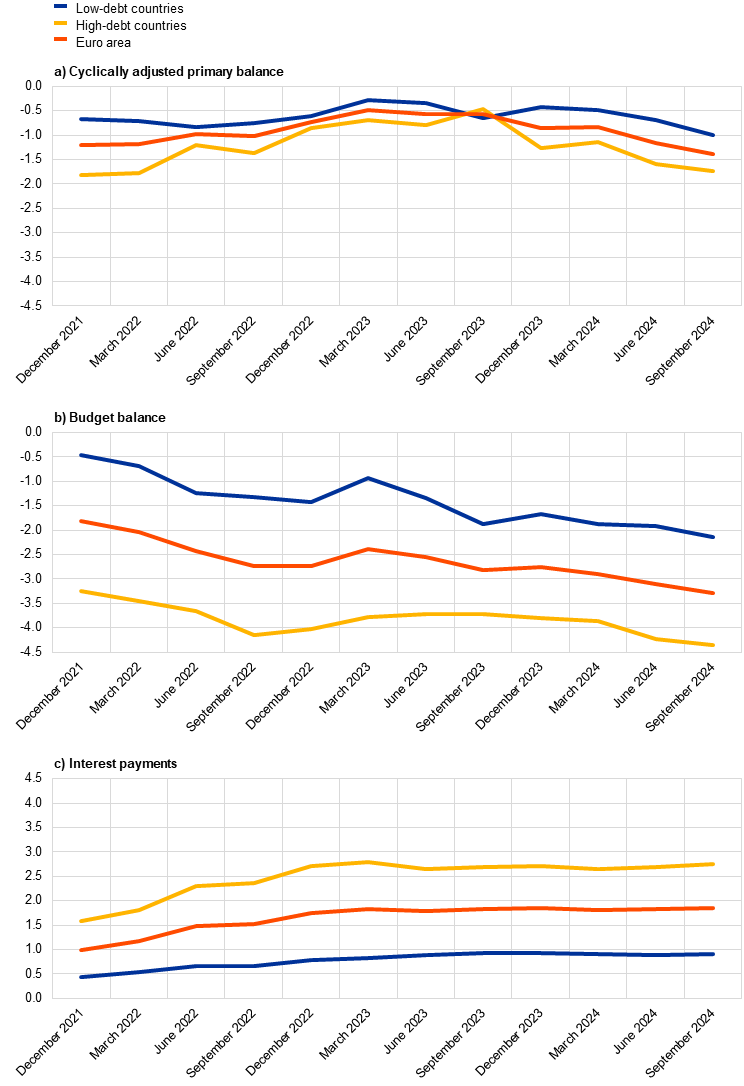

Looking back at projection rounds, the euro area cyclically adjusted fiscal position for 2024 has been consecutively revised downwards since the September 2023 projections. This recent gradual downward revision of the projected GDP-weighted average of the 2024 CAPB was observed in both the high and low-debt country groups, albeit more noticeably in the former (Chart B, panel a).[5] The high-debt group also shows a significantly larger budget deficit (Chart B, panel b), partly explained by interest payments. These are much larger than in the low-debt group and have been revised upwards more significantly since the early projection rounds (Chart B, panel c).

Some uncertainty and mixed signals continue to surround the 2024 outcome. On the one hand, 2024 fiscal positions could turn out somewhat better than shown in the September 2024 ECB staff macroeconomic projections due to expected upward revisions in GDP for several countries in the context of the 2024 benchmark national accounts statistical revisions.[6] Moreover, some governments (in Italy among the large economies, for instance) report better 2024 outcomes in their 2025 draft budgetary plans. On the other hand, the latest official estimate for the 2024 deficit in France stands at above 6% of GDP in the absence of additional consolidation measures, higher than previous estimates.

Chart B

Various fiscal indicators for 2024 across projection rounds

(percentages of GDP)

Sources: ECB staff macroeconomic projections for the euro area, September 2024, and previous projection rounds starting with Eurosystem staff macroeconomic projections for the euro area, December 2021 (first round including projections for 2024).

Notes: See notes to Chart A for calculation method for aggregates. The budget balance can be decomposed into CAPB, interest payments (interest spending on government debt) and the cyclical component (which depends on the output gap and the budget elasticities; this component of the budget balance is not shown in the chart). The CAPB is also affected by composition effects, which arise if macroeconomic tax bases change to a different extent compared with the output gap estimates.

As of 2025 countries will be subject to the fiscal requirements under the revised EU governance framework. Most euro area countries had released their draft budgetary plans for 2025 by 15 October 2024. Among other things, these set out how governments intend to comply with the new fiscal framework as of 2025. The plans available by the cut-off date for this issue of the Economic Bulletin point towards an improvement in the CAPB positions for about half of the countries, notably Germany, Italy, Malta and Slovakia.[7],[8] Among the group of high-debt countries, the CAPB remains almost unchanged for Greece and Portugal compared with 2024 as these countries envisage posting surpluses for 2025.

The European Commission is expected to assess the budgetary plans of the EU Member States in its Autumn package. The European Commission usually adopts opinions on the draft budgetary plans for the following year in late November. It is also expected to provide an assessment on whether it would recommend the European Council to endorse the medium-term fiscal structural plans that countries have to submit for the first time under the reformed fiscal framework, covering the period 2025-28.[9] These plans will outline a path of net expenditure growth that would, where applicable, allow a country to put its debt ratio on a plausibly declining trajectory over the medium term.[10] This path of net expenditure growth would need to build on the level of the corresponding expenditure aggregate as observed in 2024. Consequently, any differences between current forecasts of this year’s fiscal positions and final outcomes will later become relevant when assessing whether countries have sufficiently delivered on their medium-term fiscal structural plans.

These recommendations included country-specific fiscal guidance for 2023 and 2024 with a focus on winding down energy support measures and using the related savings to reduce government deficits, as soon as possible in 2023 and 2024. See “European Semester 2023: Country-specific recommendations for 2024”, press release, Council of the EU,16 June 2023.

See Haroutunian, S. et al. “The path to the reformed EU fiscal framework: a monetary policy perspective”, Occasional Paper Series, No 349, ECB, 2024.

For further details, see the section entitled “Fiscal developments”, Economic Bulletin, Issue 6, ECB, 2024.

Defined as euro area countries with government debt in excess of 90% of GDP in 2023, with indicators for the group presented as a GDP-weighted average.

It should be noted that for some smaller economies included in the high-debt group (with a lower GDP weight), most importantly Portugal, CAPB projections were revised upwards between the September 2023 and September 2024 projections.

For preparatory work related to the benchmark revisions, see “2024 benchmark revision of national accounts and balance of payments: Overview on motivation, main changes and implementation aspects”, press release, Eurostat, 29 February 2024. For a limited set of countries, the fiscal positions in the September 2024 projections reflect, at least in part, the revisions to benchmark national accounts.

Due to different methods of calculating the cyclical adjustment, the estimates in the draft budgetary plans are not fully comparable to the ECB methodology used in the September 2024 ECB staff macroeconomic projections.

By the cut-off date for this issue of the Economic Bulletin (16 October 2024), draft budgetary plans for Belgium, Spain, France, Croatia, Lithuania and Austria had not been posted on the Commission’s dedicated webpage.

The Commission’s package will also include recommendations under Article 126(7) of the Treaty on the Functioning of the European Union (TFEU) with a view to correcting excessive deficits in seven EU Member States (Belgium, France, Italy, Hungary, Malta, Poland and Slovakia).

“Net expenditure” means government expenditure net of interest expenditure, discretionary revenue measures, expenditure on programmes of the Union fully matched by revenue from Union funds, national expenditure on co-financing of programmes funded by the Union, cyclical elements of unemployment benefit expenditure, and one-offs and other temporary measures (see Regulation (EU) 2024/1263 Article 2(2)).