- THE ECB BLOG

What to do about Europe’s climate insurance gap

24 April 2023

The EU has a problem with climate catastrophe insurance: only a quarter of the losses from climate-related disasters are covered. Greater coverage could reduce the economic damage that results from them. This joint ECB-EIOPA post for The ECB Blog looks at ways to make this happen.

Drought affected two-thirds of the European Union in 2022, likely the worst episode in 500 years.[2] Agricultural production withered, river transport was disrupted and hydroelectric power generation fell, which exacerbated the energy crisis. Just a year earlier, severe flooding across the continent killed hundreds and caused substantial damage. Climate change will make catastrophes like these more frequent and more severe.

Putting the brake on climate change by accelerating the green transition remains vital. But we also need policies to lessen the impact of catastrophes when they occur. Insurance plays an important role in this. By promptly providing funds for reconstruction, insurance allows economic activities to return to pre-catastrophe levels more quickly.[3] So high rates of coverage and speedy pay-outs can substantially mitigate the economic damage. They can also reduce financial stability risks and lower the cost to taxpayers of government relief to cover uninsured losses.

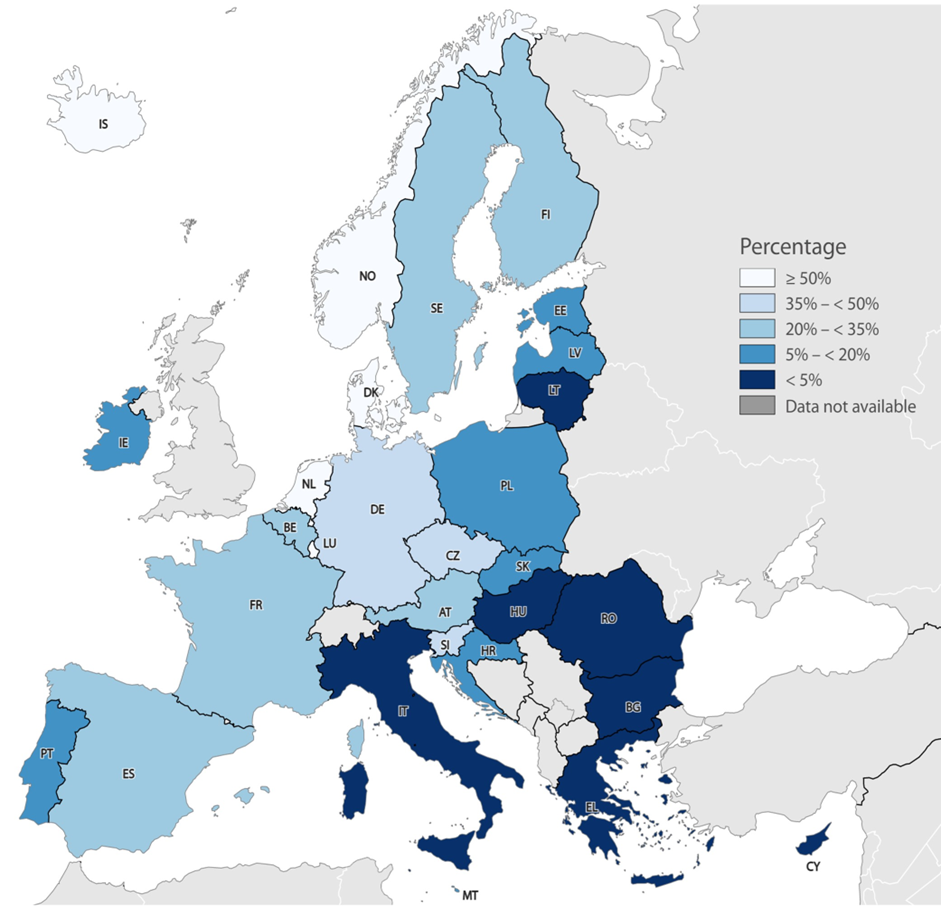

So, are we covered when disaster strikes? No, the EU actually has a major climate insurance protection gap. Only a quarter of climate-related catastrophe losses are insured. In some countries, the figure is less than 5% (Figure 1). Moreover, the growing effects of climate change mean that coverage is likely to shrink as rising premiums choke demand and insurers withdraw from particularly exposed areas.

Figure 1

The insured share of economic losses related to catastrophes in Europe is low and expected to decline

Average share of insured economic losses caused by weather-related events in Europe

1980-2020 percentages

Sources: EIOPA Protection Gap Dashboard, European Environment Agency (EEA) CATDAT.

Even when insurance coverage is affordable, there are various reasons why it is not purchased. For one, people generally underestimate the likelihood and impact of catastrophes. For another, they often believe governments will compensate them for losses and that they therefore do not need their own insurance. This behaviour is a well-known challenge for insurance and is called moral hazard. Broadly speaking, moral hazard is where people do not make the effort to reduce risks themselves because they expect to be compensated for their loss anyway.

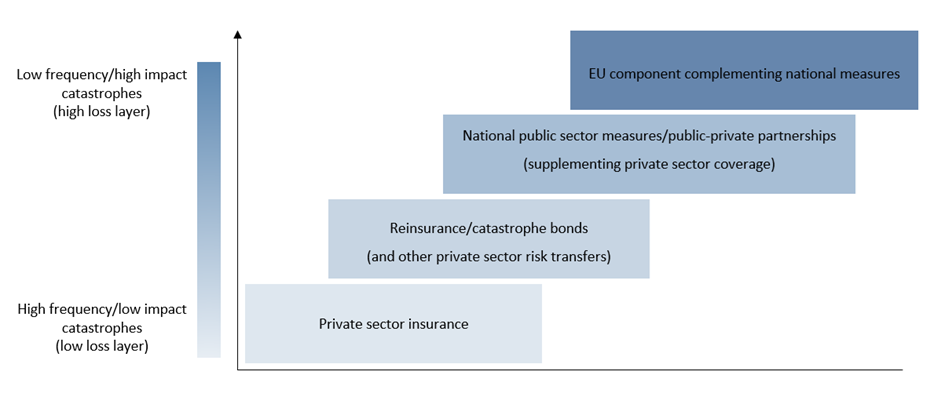

A ladder approach to catastrophe insurance

The ECB and the European Insurance and Occupational Pensions Authority (EIOPA) are working together to find ways to address the problem. Today they published a joint Discussion Paper outlining policy options to reduce the climate insurance protection gap in Europe. Insurance and catastrophe losses come in several layers. The Discussion Paper uses the concept of a ladder to help visualise these layers and tailor the proposed policy options to them (Figure 2).

The first rung of the ladder is private insurance, the initial line of defence to pool risks and cover losses. Carefully designed insurance policies can encourage households and businesses to better adapt to climate change and increase their resilience, for example by setting standards for flood-proofing homes in flood-prone areas.

Figure 2

A ladder approach to catastrophe insurance

Source: Simplified version of figure appearing in ECB-EIOPA discussion paper ”Policy options to reduce the climate insurance protection gap” (2023).

Larger catastrophe risks, however, require a more elaborate framework. The next rung involves reinsurance and greater use of capital market instruments such as catastrophe (“cat”) bonds. Cat bonds can help insurers pass on part of the losses from rarer, but more devastating, catastrophes to a broad set of investors, helping to diversify sources of capital and lower overall premiums. Deepening cat bond markets – which may also be supported by further progress on the EU’s Capital Markets Union – can therefore help to tackle the climate insurance protection gap.

The third rung comprises the important roles played by national governments. As already noted, low insurance coverage means that the public sector often has to provide disaster relief. Public finances would generally benefit from more comprehensive disaster risk management strategies. These make it easier to balance the costs of measures taken before catastrophes occur against the relief provided once they eventually do. Precautionary measures include spending on climate adaptations such as sea walls or irrigation, as well as creating fiscal buffers such as national reserve funds for emergencies. Even with such preparations, fiscal spending will remain an important part of catastrophe relief, especially for cases such as public infrastructure. Governments could also enter into the type of public-private partnerships that already exist in some European countries, either via direct insurance or as reinsurer of last resort. A key objective of policy at this level should be to lower the share of catastrophe losses borne by the public sector, while simultaneously incentivising and improving risk mitigation and adaptation.

The final rung on the ladder is a possible EU-wide public sector scheme covering rarer, but larger, climate-related catastrophes. By providing meaningful reconstruction support to Member States, it could complement and reinforce national measures, and help to more efficiently pool catastrophe risks, which typically hit individual EU countries at different times. Such a scheme would complement the EU’s wider climate policies and existing tools for disaster relief, such as the EU Solidarity Fund, that cannot singlehandedly meet the increasing needs from climate-related catastrophes.

As set out in the Discussion Paper, all these policy options must be carefully designed and implemented so that the behaviour that generates moral hazard does not simply move to a different rung in the ladder. The EU-wide public sector scheme, for example, would need safeguards to ensure Member States also act to improve resilience to catastrophes rather than solely relying on relief from the EU. These safeguards could include partially linking contributions to actual risk exposure and only granting access once Member States have implemented agreed adaptation strategies and met their emissions reduction targets.

It will not be possible to fully insure against all future catastrophe risks, nor would doing so be a good idea if we want to encourage adaptation to climate change. Nonetheless, considering the steps outlined here should help to make Europe more resilient to future catastrophes, and lessen their macroeconomic, financial and fiscal impacts.

The ECB and EIOPA welcome comments and feedback on all aspects of the Discussion Paper. Comments should be sent to [email protected], ideally by 15 June 2023.

For information: The ECB and EIOPA are jointly hosting a workshop on 22 May 2023 where these policy options will be discussed with regulators, policymakers, academics and representatives from the private sector.

Nicholai Benalal, Marien Ferdinandusse, Sujit Kapadia, Linda Rousová, Elisa Telesca and Pär Torstensson (ECB), Luisa Mazzotta, Marie Scholer, Pamela Schuermans and Dimitris Zafeiris (EIOPA).

See European Commission Press Release (French) and Global Drought Observatory (2022) Drought in Europe – August 2022.

See, for example, von Peter, G., von Dahlen, S. and Saxena, S., (2012), “Unmitigated disasters? New evidence on the macroeconomic cost of natural catastrophes”, BIS Working Paper No. 394; Fache Rousová, L., Giuzio, M., Kapadia, S., Kumar H., Mazzotta, L., Parker, M., Zafeiris, D., (2021), “Climate change, catastrophes and the macroeconomic benefits of insurance”, EIOPA Financial Stability Report, July.